European Insurance | The way forward

3.99$

The future of European insurance and well being beyond 2021, it a premium compilation by Team PPT Infographics. This report covers at a high level, the current state of European Insurance Market, and its aging population’s insurance needs. The report further explores the unique insurance requirements of European seniors and how insurance players can create an insurance ecosystem with connected and seamless offerings. The report also explores possible Go-To-Market Strategy for Insurance Players and a clear the possibility of first movers advantage.

“European insurance strategy, The way forward, Beyond 2021”

Table of Contents:

- Europe’s Aging Population, Growing % of senior population in total population

- Understanding Europe’s Insurance Market, Tailored offerings for the senior segment

- Decoding Seniors Insurance Needs, Key Offerings in the Seniors Insurance Space, Insurance Ecosystem Go-To-Market Strategy, Key aspect of the go-to-market approach in European Insurance Market

- The Way Forward, Three key priorities for Insurance players in Europe

- Reference & Disclaimers

Europe’s Aging Population

Let’s look into some facts. Seniors hold significant share of total wealth. For example, In Italy and Netherlands, approximately 20% of the total population is seniors, but they hold more than 40% of total wealth. On the other hand we consistent Increase in population over 80 years. There are many more such references. As per an estimate, the proportion of population over 80 years is likely to double by the

end of 21st century. To add to this, the old age dependency ratio is increasing as well. In 2001 there were 4 working people for every senior person, by 2050 there will be less than 2.

Understanding Europe’s Insurance Market

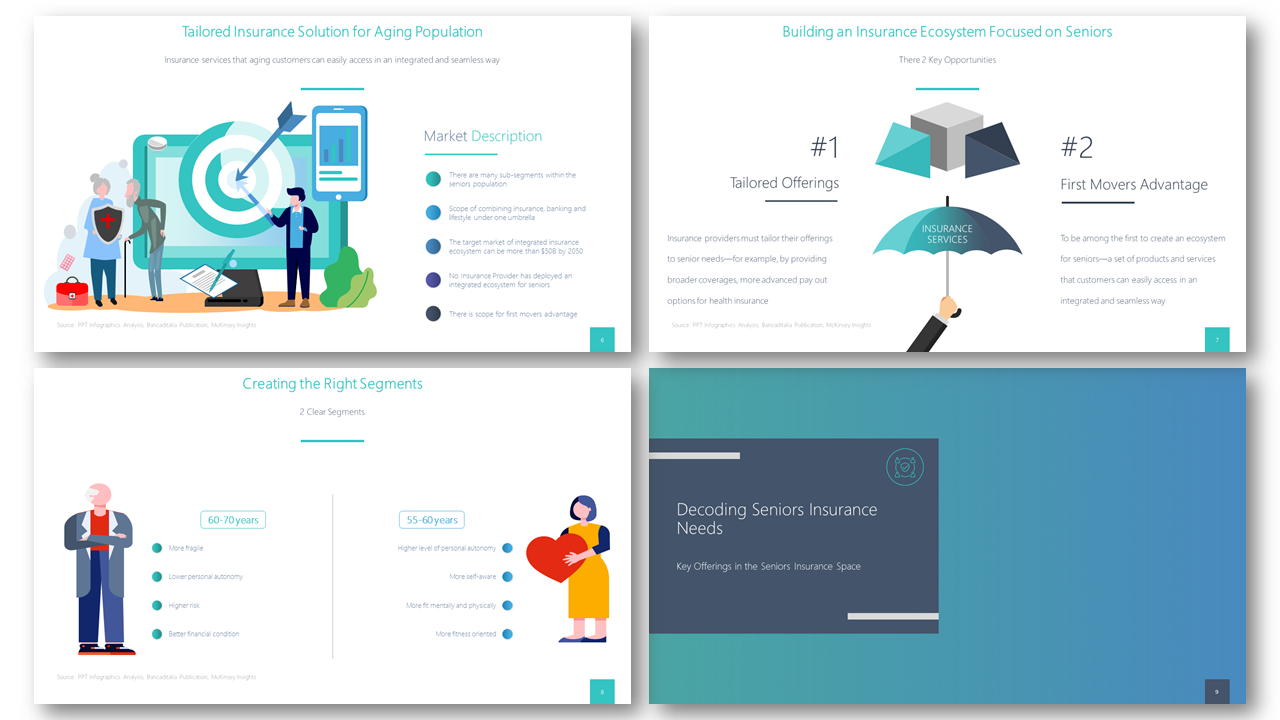

There is a clear need for reimagining insurance services, that aging customers can easily access in an integrated and seamless way. The insurance service providers need to realize that there are many sub-segments within the senior population. There is clear scope simplification by combining insurance, banking and lifestyle under one umbrella. As per market projections, the target market of integrated insurance ecosystem can be more than $50B by 2050. So far no insurance provider has deployed an integrated ecosystem for seniors. There is clear scope for first mover’s advantage!

Building an insurance ecosystem for seniors provide 2 key opportunities. First, the insurance providers must tailor their offerings to senior needs—for example, by providing broader coverage, more advanced pay out options for health insurance. Secondly, there is a clear first movers advantage, an open market to be among the first to create an ecosystem for seniors—a set of products and services that customers can easily access in an integrated and seamless way.

Decoding Seniors Insurance Needs

If we take a closer look there are 2 clear segments that are emerging. These are seniors between 60-70 years and between 55-60 years. The 60-70 years old segment is more fragile, with lower personal autonomy, higher risk, but with better wealth condition. Whereas the 55-60 years old segment has higher personal autonomy, more self-aware and fitness oriented. Both these segments need to be addressed separately, but there are few common points.

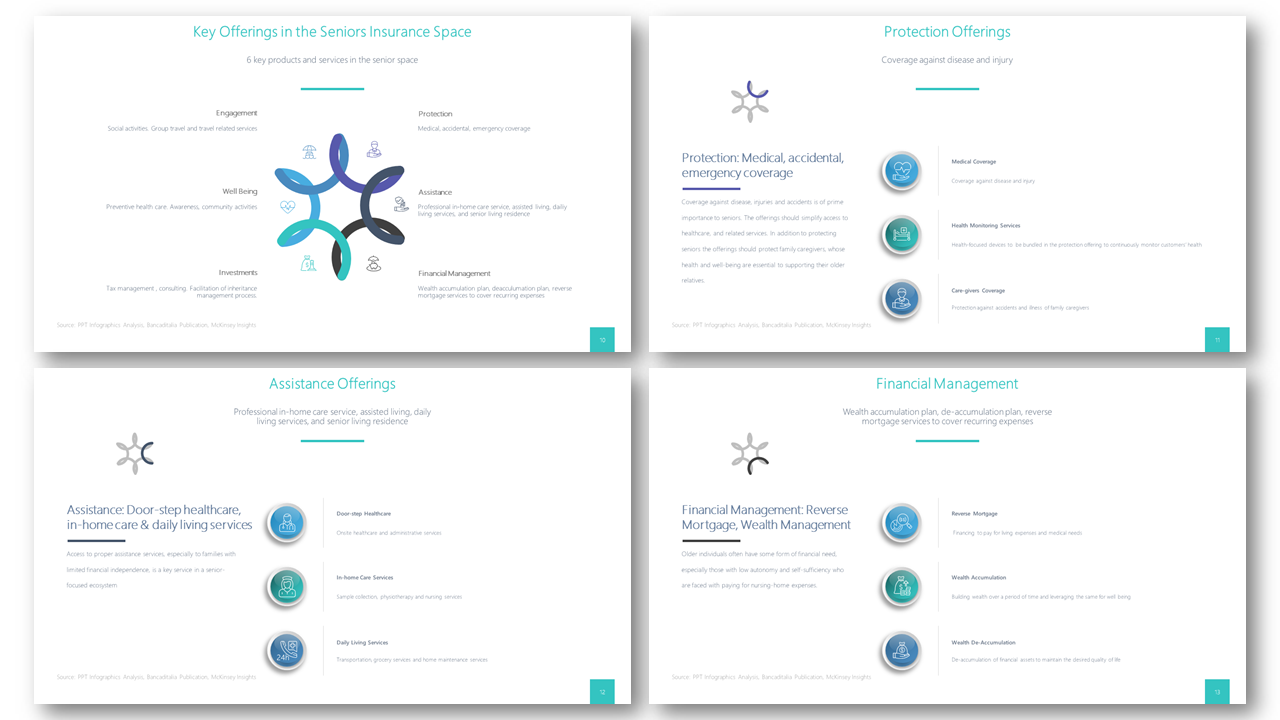

Among the common services are: Tax management, Facilitation of inheritance management process. Preventive health care. Community activities, Social activities. Group travel and travel related services, Engagement, Investments, Well Being , Protection , Medical, accidental, emergency coverage, Assistance , Professional in-home care service, assisted living, daily living services, and senior living residence , Financial Management , Wealth accumulation plan, de-accumulation plan, reverse mortgage services to cover recurring expenses

Insurance Ecosystem Go-To-Market Strategy

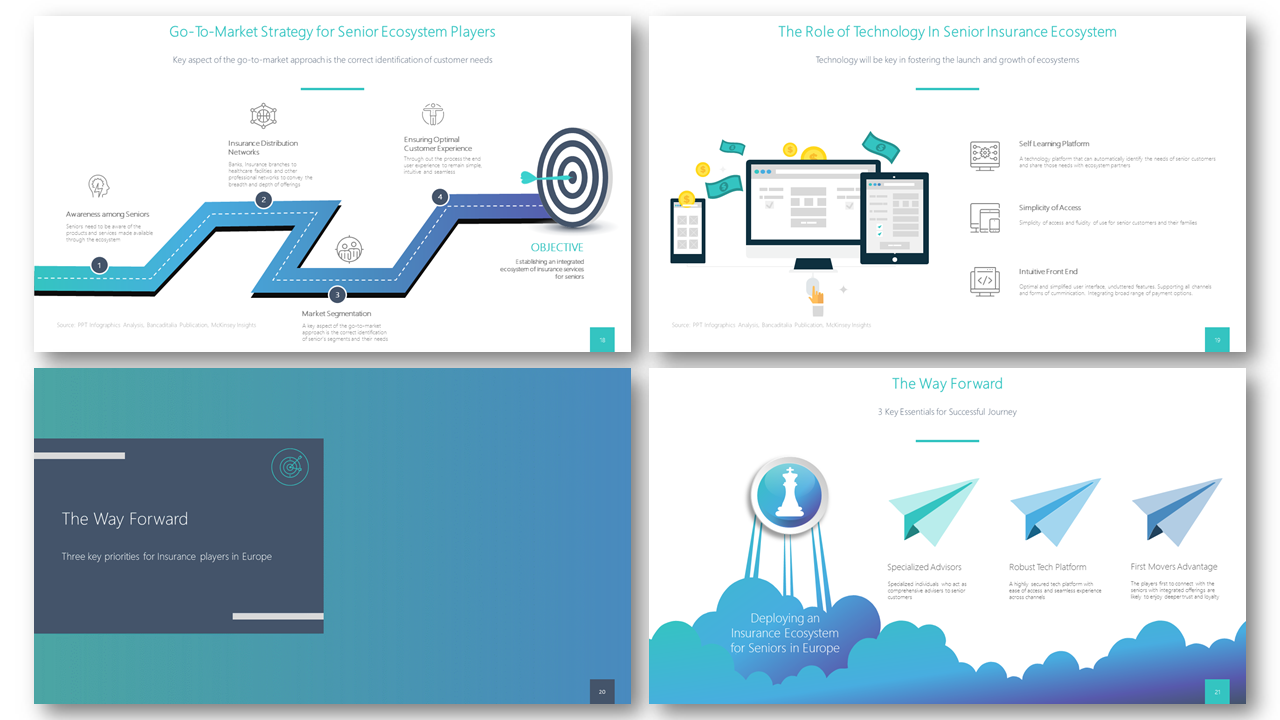

The Go-To-Market Strategy for Senior Ecosystem Players is poised to address some basic needs. Firstly, creating awareness among seniors. Seniors need to be aware of the products and services made available through the ecosystem. Next, setting up insurance distribution network. This can include banks, insurance branches to healthcare facilities and other professional networks to convey the breadth and depth of offerings. Next comes is right market segmentation. A key aspect of the go-to-market approach is the correct identification of senior’s segments and their needs. In addition, the insurance players need to ensure optimal customer experience. We need to ensure that throughout the process the end user experience to remain simple, intuitive and seamless. And finally, establishing an integrated ecosystem of insurance services for seniors with the objective of establishing an integrated ecosystem of insurance services for seniors.

In achieving the above insurance operations strategy, technology will be key in fostering the launch and growth of ecosystems. A suitable self-learning platform ensuring simplicity of access, seamless connectivity, with an intuitive front end is likely to play a key role. The platform should automatically identify the needs of senior customers and share those needs with ecosystem partners, ensures simplicity of access and fluidity of use for senior customers and their families, optimal and simplified user interface, uncluttered features. Supporting all channels and forms of communication and integrating broad range of payment options.

There are 3 key elements in deploying an insurance ecosystem for seniors in Europe. These are specialized advisors, a Robust Tech Platform, and First Movers Advantage. Specialized individuals are those who act as comprehensive advisers to senior customers. The players first to connect with the seniors with integrated offerings are likely to enjoy deeper trust and loyalty.

Only logged in customers who have purchased this product may leave a review.

Related products

Premium Templates

Premium Templates

Premium Templates

Impact of AI on clinical trials, AI in drug discovery and development.

Premium Templates

Premium Templates

Top HR Trends 2023/24: Decoding the Future of Your Workforce

Premium Templates

You may also like…

Mega Deals

Reviews

There are no reviews yet.