Tax Deductions for Freelancers PowerPoint Template Download

Tax Deductions for Freelancers are crucial for maximizing earnings and minimizing tax liabilities. This PowerPoint template serves as an essential guide, providing clear tax deduction guidelines presentation and practical expense management PowerPoint template features to simplify financial planning for freelancers.

$1.00 Original price was: $1.00.$0.50Current price is: $0.50.

Achieve precision and creativity in your slides with Tax Deductions for Freelancers PowerPoint Template Download. This professionally designed PowerPoint template includes multiple editable slides, data-driven reports, financial forecasting, and performance analysis. Customize this template effortlessly to suit various presentation needs.

Only logged in customers who have purchased this product may leave a review.

Related products

Warning: Undefined array key "pages" in /home/u187038440/domains/pptinfographics.com/public_html/wp-content/themes/flatsome-child/woocommerce/single-product/related.php on line 66

Expense Management

Expense Management

Utilizing E-Procurement Tools PowerPoint Template for Professionals

Expense Management

Expense Management

Understanding Qualified Business Income PowerPoint Template for Professional Presentation

Expense Management

PowerPoint Template for Training Employees on Expense Policies

Expense Management

PowerPoint template for Tracking Invoice Approval Metrics Slides

Expense Management

Tracking Corporate Card Expenses PowerPoint Template for Professionals

Expense Management

Expense Management

Tools for Compliance Monitoring PowerPoint Template for Professionals

Expense Management

Tools for Budget Monitoring PowerPoint Template for Professionals

Expense Management

Tips for Reducing Monthly Costs PowerPoint Template Download

Expense Management

Tax Benefits of Charitable Donations PowerPoint Template Download

Expense Management

Supplier Cost Reduction Strategies PowerPoint Template Download

Expense Management

PowerPoint template for Streamlining Vendor Payments Workflow

Expense Management

You may also like…

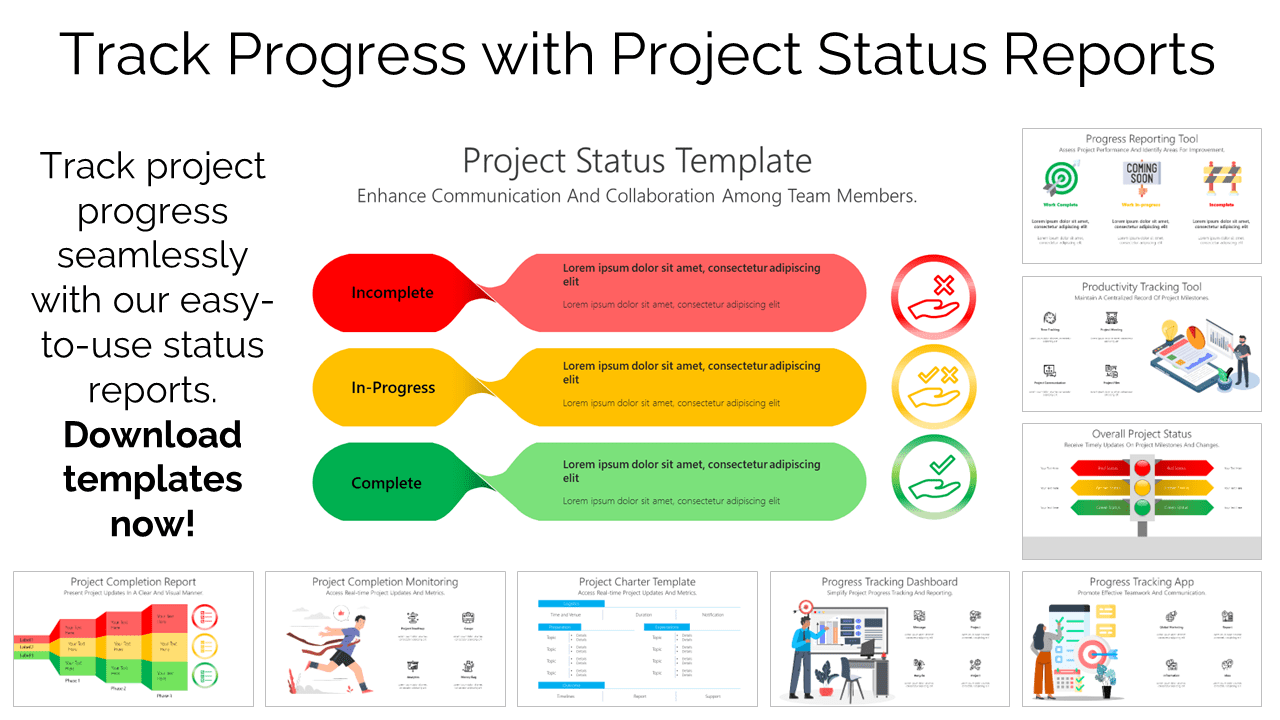

Project Management Infographics

Project Management Infographics

Mega Deals

E-Commerce Infographics

Reviews

There are no reviews yet.